Divorce Mortgage Guide: Buyout, Refinance, and Property Division Strategies

Divorce Mortgage Guide: Buyout, Refinance, and Property Division Strategies

Understanding Divorce Refinance and Assumable Mortgage Options

Going through a divorce is one of life’s most challenging transitions—emotionally, legally, and financially. When a home is involved, the mortgage becomes a central part of the settlement process. Whether you’re removing an ex-spouse from the loan, buying out their share, or deciding who keeps the home, understanding your mortgage options can bring clarity to an otherwise overwhelming situation.

In this guide, you’ll discover:

- How mortgage buyout refinancing works during property division (according to CFPB mortgage guidance)

- The difference between assuming a mortgage versus refinancing

- Timing strategies that protect your credit during separation (per FTC consumer credit rules)

- Qualification requirements after divorce

- How to handle equity division strategically (following IRS mortgage interest guidelines)

Questions about your situation? Schedule a call to speak with a loan advisor who understands the complexities of divorce mortgage scenarios.

What Is a Divorce Mortgage Refinance?

A divorce mortgage refinance is when one spouse refinances the existing mortgage into their name alone, effectively removing the other spouse from the loan obligation. This typically happens when one party wants to keep the home and needs to “buy out” the other’s equity share.

How does it work in practice? Let’s say you and your spouse own a home worth a substantial amount with a moderate remaining mortgage balance. If you want to keep the home, you’ll need to refinance the mortgage in your name only and pay your ex-spouse their portion of the equity as part of the divorce settlement.

This process involves getting approved for a new mortgage based solely on your income, credit, and debt-to-income ratio—without your spouse as a co-borrower.

Why Divorce Refinancing Matters for Homeowners

Can you keep living in the marital home? For many homeowners going through divorce, the house represents more than just property—it’s where memories were made, where children grew up, and sometimes where you want to continue building your future.

But keeping the home means taking full financial responsibility. Here’s why the refinancing decision matters:

- Credit protection: Until you refinance, both spouses remain responsible for the mortgage. If your ex-spouse misses payments, your credit suffers too

- Equity access: A cash-out refinance lets you tap home equity to pay the buyout amount rather than depleting savings

- Financial independence: Refinancing establishes clear ownership and removes the financial ties to your former spouse

- Future flexibility: Once the home is solely in your name, you can make decisions about renovations, HELOCs, or future refinancing without needing your ex-spouse’s cooperation

Use the cash-out refinance calculator to see how different equity scenarios affect your monthly payment and available cash.

How Does the Divorce Buyout Process Work?

The divorce buyout refinancing process typically follows these stages:

Step 1: Determine Home Value and Equity

What’s your home actually worth? Order a professional appraisal to establish the current market value. This becomes the foundation for calculating each spouse’s equity share.

Example calculation:

- Current home value: Substantial amount

- Remaining mortgage: Moderate balance

- Total equity: Significant equity to divide

- Each spouse’s share (if equal): Roughly half

Step 2: Negotiate the Settlement

Who gets what? Work with your attorneys to determine:

- Which spouse keeps the home

- How equity will be divided

- Whether other assets offset the home equity

- Timeline for refinancing completion

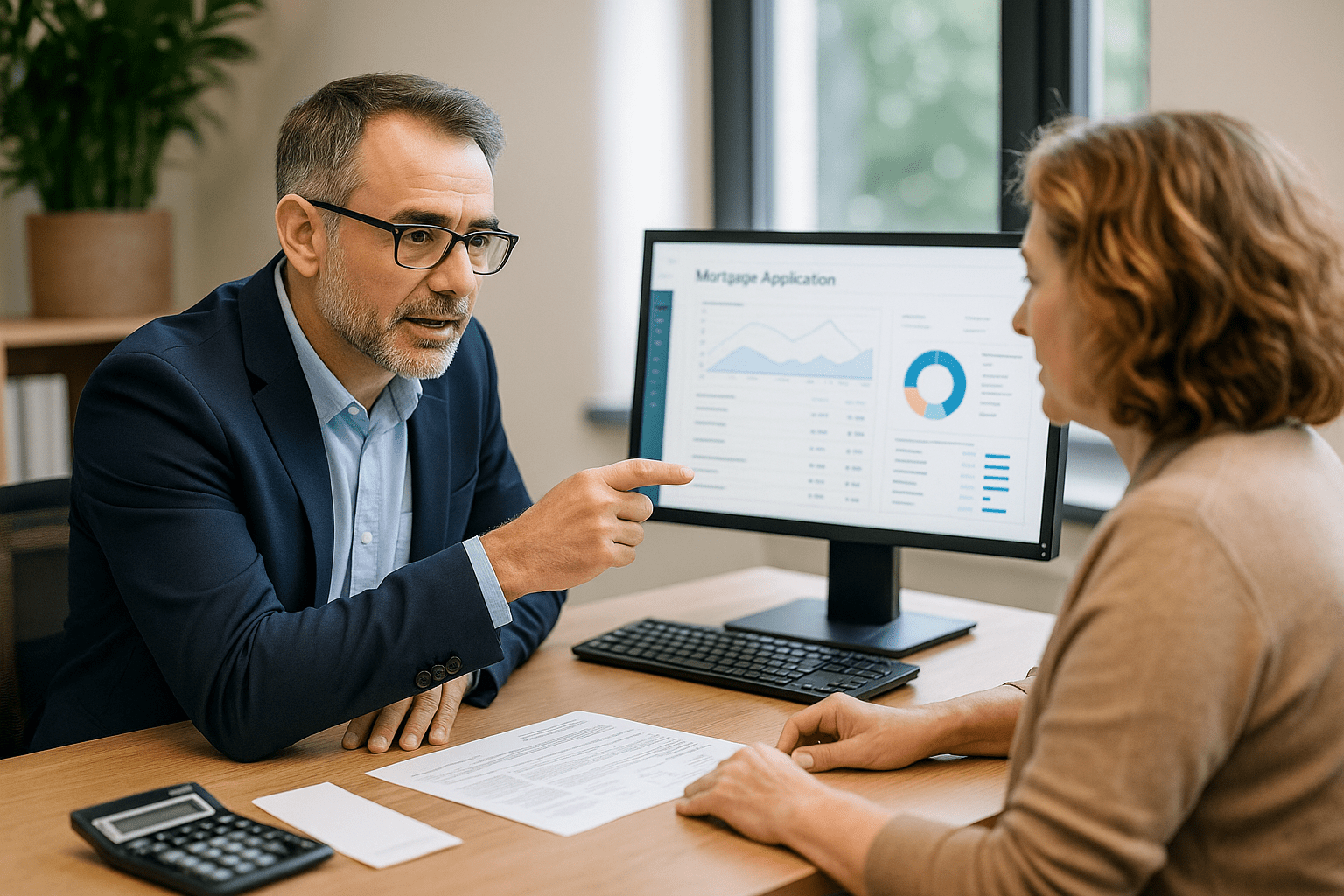

Step 3: Qualify for the New Mortgage

Can you afford it alone? The remaining spouse must qualify for the new mortgage based on their individual financial profile:

- Income sufficient to cover the full payment

- Credit score meeting lender requirements

- Debt-to-income ratio within acceptable limits

- Documented ability to make the buyout payment

This is where many homeowners discover they need specialized loan options. If you’re self-employed, consider bank statement loans that don’t rely on tax returns. For veterans, VA loans offer favorable refinancing terms.

Step 4: Complete the Refinance

What happens at closing? Once approved:

- The existing mortgage is paid off

- A new mortgage is created in one spouse’s name only

- The departing spouse is removed from the title

- Buyout funds are distributed according to the settlement agreement

See how it worked in this VA loan refinance case study where a Coast Guard veteran successfully removed an ex-spouse after divorce.

Divorce Refinance vs. Assumable Mortgage: What’s the Difference?

Should you assume the existing mortgage or refinance? This is one of the most common questions in divorce mortgage situations.

Assumable Mortgage Divorce Scenario

An assumable mortgage allows one spouse to take over the existing loan with its current terms—potentially without refinancing. However:

- Only certain loan types are assumable (FHA, VA, USDA)

- The lender must approve the assumption

- The assuming spouse must qualify individually

- The departing spouse may remain partially liable unless released

- Rates and terms stay the same (good if rates are favorable)

When does assumption make sense? If you have a low interest rate from several years ago and current rates are higher, assuming the existing loan preserves that favorable rate.

Refinancing for Divorce

A full refinance creates an entirely new loan:

- Works with any loan type

- Completely removes the ex-spouse from obligation

- Provides cash-out option for buyout payments

- Reflects current market rates (which could be higher or lower)

- Establishes fresh terms and conditions

Use the conventional loan refinance calculator to compare your current payment against potential refinanced scenarios.

The critical question: Which option better protects both parties? Refinancing typically provides cleaner separation, while assumption may preserve better terms if rates have risen.

Who Should Consider Divorce Mortgage Refinancing?

Divorce refinancing makes sense when:

You Want to Keep the Family Home

Why stay? Common reasons include:

- Children’s stability and school district

- Neighborhood connections and community ties

- Avoiding the disruption of moving during an already difficult time

- Building equity in a home you love

If you’re planning to age in place or renovate the home post-divorce, explore home improvement loan options or consider the FHA 203k loan for purchase-plus-renovation scenarios.

You Can Qualify on Your Own Income

Do the numbers work? You’ll need:

- Stable income sufficient for the full mortgage payment

- Good credit history (typically mid-600s or higher)

- Manageable debt-to-income ratio

- Reserves for closing costs and buyout payment

You Want Clean Financial Separation

How do you protect yourself? Refinancing provides:

- Complete removal of ex-spouse from loan documents

- Solo control over future mortgage decisions

- Protection against ex-spouse’s potential payment defaults

- Clear ownership for future selling or refinancing

You Need to Access Equity

Where does the buyout money come from? Many homeowners use cash-out refinancing to:

- Pay the ex-spouse’s equity share

- Cover divorce-related expenses

- Consolidate debt accumulated during separation

- Create financial breathing room post-divorce

Learn how others navigated similar situations in this conventional loan cash-out refinance case study.

Common Mortgage Scenarios During Divorce

Scenario 1: One Spouse Keeps the Home

What are your options?

- Refinance to remove departing spouse

- Use cash-out refinance for buyout payment

- Negotiate other assets to offset equity share

- Structure payments over time per court order

This is the most common scenario. The FHA streamline refinance offers a simplified process if you currently have an FHA loan.

Scenario 2: Sell the Home and Split Proceeds

When does selling make sense?

- Neither spouse can qualify alone

- Home has substantial equity to divide

- Both want a fresh start

- Market conditions favor selling

Scenario 3: Co-Own Until a Triggering Event

Can you delay the decision? Some agreements specify:

- One spouse lives in the home

- Both remain on mortgage temporarily

- Sale or refinance triggered by specific events (child graduates, remarriage, set timeframe)

Warning: This arrangement carries risks. Both parties remain liable for the mortgage, and future refinancing may be complicated by changing financial circumstances.

Scenario 4: The “Nesting” Arrangement

What if children stay in one home? Some divorced parents:

- Keep the family home for children’s stability

- Take turns living there according to custody schedule

- Both remain on mortgage and share expenses

- Eventually sell or refinance when children age out

While this prioritizes children’s needs, it requires exceptional cooperation and clear financial agreements.

Credit and Qualification Considerations After Divorce

How does divorce affect your mortgage eligibility? Several factors come into play:

Income Documentation Challenges

What if your income changed?

- Lost spouse’s income from qualification calculation

- May need to document alimony or child support (typically must receive it for several months to a year before it counts)

- Self-employment income requires specialized documentation via bank statement loans

- Part-time or variable income needs careful verification

Credit Score Impact

How do you protect your credit during divorce?

- Monitor all joint accounts closely

- Make payments on time despite personal turmoil

- Consider paying off joint debts before finalizing divorce

- Document any agreements about who pays what

What if your credit suffered during separation? Give yourself time to rebuild before refinancing. Typically, lenders want to see consistent on-time payments and credit scores in the qualifying range.

Debt-to-Income Ratio

Will you qualify based on debt-to-income? Lenders calculate:

- Your new solo mortgage payment

- All other debts (car loans, student loans, credit cards)

- Alimony or child support payments (subtracted from income)

- New mortgage divided by gross monthly income

Use the divorce buyout calculator to see if your numbers work.

Assuming vs. Removing from Existing Obligations

What happens to joint debts? Even if the divorce decree assigns debts to one spouse:

- Lenders still hold both parties responsible

- Late payments affect both credit scores

- Refinancing is the only way to legally remove someone from a mortgage

Timing Your Divorce Mortgage Strategically

When should you refinance—before or after the divorce is final?

Before the Divorce Finalizes

Pros:

- Can still use combined income if needed

- May qualify for better terms together

- Locks in current rates

- Eliminates uncertainty about future qualification

Cons:

- Requires cooperation during difficult time

- May complicate legal proceedings

- Could change if circumstances shift

After the Divorce Finalizes

Pros:

- Clear ownership established by court

- Buyout amounts determined

- No need for ex-spouse cooperation

- Fresh start mentality

Cons:

- Must qualify on solo income

- Rates may have changed

- Temporary period where both remain liable

- Potential credit damage if payments missed

The Waiting Period Strategy

Should you wait to rebuild credit or income? Sometimes the best strategy is patience:

- Spend several months improving credit score

- Establish new income history (especially if you returned to work)

- Save for larger down payment or buyout funds

- Let housing market conditions improve

How long do divorce settlements give for refinancing? Many agreements specify timeframes ranging from a few months to a year or more. Work with your attorney to ensure realistic deadlines.

Protecting Your Credit During the Separation Process

What if your ex-spouse stops paying? This is a critical concern. Until you refinance:

- Both spouses remain fully liable for the mortgage

- One person’s missed payment damages both credit scores

- Lenders can pursue either party for the full debt

- Divorce decrees don’t protect you from creditors

Protective Strategies

How do you minimize risk?

- Document everything: Keep records of all payments you make

- Set up alerts: Monitor the mortgage account for missed payments

- Make payments yourself if needed: Protect your credit even if it means covering your ex’s share temporarily

- Refinance quickly: Don’t delay removing yourself from jointly held debt

- Consider a quitclaim deed carefully: Removing someone from title doesn’t remove them from the mortgage

What’s a quitclaim deed? This transfers ownership interest but doesn’t affect mortgage responsibility. You can own zero percent of a home but still be fully responsible for a mortgage on it—a dangerous situation.

How Stairway Mortgage Helps During Divorce Transitions

At Stairway Mortgage, we understand that divorce mortgage situations require sensitivity, expertise, and creative problem-solving. We’ve guided hundreds of homeowners through this transition by:

Exploring All Your Options

What if traditional refinancing doesn’t work? We have access to specialized loan programs:

- FHA loans with more flexible qualification

- VA loans for veterans removing non-veteran spouses

- Bank statement loans for self-employed borrowers

- Asset-based lending when income is complex

Structuring the Right Solution

How do we customize the approach?

- Cash-out refinancing for buyout payments

- Rate-and-term refinancing to maintain affordability

- HELOC options for flexible equity access

- Combination strategies that address multiple needs

Timing It Right

When is the best time to act? We help you:

- Assess your current qualification status

- Project future eligibility based on changing circumstances

- Coordinate with divorce attorney timelines

- Lock rates at optimal moments

Protecting Both Parties

Can we help the departing spouse too? Often yes:

- Ensure they’re properly removed from obligations

- Facilitate clean separation of mortgage responsibility

- Provide documentation for legal proceedings

- Offer future homebuying guidance when they’re ready

Ready to discuss your specific situation? Schedule a confidential call to explore your options without obligation.

Ready to Move Forward with Confidence?

Divorce is difficult enough without mortgage complications adding to your stress. The right refinancing strategy can provide:

- Financial independence and clean separation

- Protection for your credit and future

- Stability for your family during transition

- Foundation for your next chapter

What’s your next step?

If you’re considering divorce refinancing or need to remove an ex-spouse from your mortgage:

- Get pre-qualified to understand your options

- Use our calculators to run different scenarios

- Schedule a consultation to discuss your unique situation

You don’t have to navigate this alone. Let’s find the mortgage solution that helps you move forward with confidence.

Frequently Asked Questions

Can I refinance the house during a divorce before it’s finalized?

Yes, you can refinance before the divorce is final, but it requires careful coordination with your legal proceedings. Some couples refinance before finalizing to take advantage of combined income qualification or lock in favorable rates. However, the refinance must align with your divorce settlement terms. Consult both your attorney and mortgage advisor to ensure the timing works for your situation. In some cases, waiting until after finalization provides cleaner separation.

How soon after divorce can I qualify for a mortgage?

You can typically qualify for a mortgage immediately after divorce if you meet standard lending criteria—sufficient income, good credit, and acceptable debt-to-income ratio. There’s no mandatory waiting period after divorce itself. However, if your credit score dropped during the separation or you’re now relying on alimony or child support for qualification, you may need to wait several months to establish a payment history. Each situation is unique, so schedule a consultation to assess your specific timeline.

What if my ex-spouse won’t cooperate with refinancing?

If your divorce decree requires refinancing but your ex-spouse refuses to cooperate, you have legal options. First, work with your attorney—they can petition the court to enforce the decree. In some cases, courts can order cooperation or impose penalties for non-compliance. From a mortgage perspective, you may need to explore assumption options or seek court intervention for signing authority. This is a legal matter as much as a financial one, requiring coordination between your attorney and lender.

Do I have to refinance if the divorce decree says I get the house?

While the divorce decree establishes legal ownership, it doesn’t automatically remove your ex-spouse from the mortgage obligation. The lender isn’t bound by divorce decrees—both original borrowers remain liable until the mortgage is refinanced or paid off. If you don’t refinance, your ex-spouse stays on the loan and their credit remains at risk if you miss payments. Most divorce settlements include a timeframe requirement for refinancing specifically to resolve this issue. Check our conventional loan refinance options to start the process.

Can I use alimony or child support income to qualify for a refinance?

Yes, alimony and child support can be used to qualify for a mortgage refinance, but lenders have specific requirements. Typically, you must receive the payments consistently for several months to a year (depending on the lender) and provide documentation that payments will continue for at least several more years. You’ll need copies of the divorce decree, evidence of payment history (bank statements showing deposits), and sometimes verification from your ex-spouse or attorney. The divorce buyout calculator can help you see how this income affects your qualification.

Also Helpful for Homeowners

- HELOC vs. Cash-Out Refinance – Understanding which equity access tool fits your divorce buyout needs

- Home Improvement Loans – Renovating your space for your fresh start

- Refinancing for Lower Payments – Reducing housing costs on a single income

What’s Next in Your Journey?

- Removing a Co-Borrower – Refinance strategies for solo mortgage ownership

- Accessing Home Equity – Cash-out refinancing for financial flexibility post-divorce

- Credit Recovery – Rebuilding your financial foundation after separation

Explore Your Complete Options

- All Loan Programs – Find specialized options for your situation

- Mortgage Calculators – Run scenarios for different refinance strategies

- Success Stories – See how others navigated divorce mortgage challenges

- Get Pre-Approved – Start your refinancing journey today

- Schedule a Call – Discuss your unique divorce mortgage situation

Need a Pre-Approval Letter—Fast?

Buying a home soon? Complete our short form and we’ll connect you with the best loan options for your target property and financial situation—fast.

- Only 2 minutes to complete

- Quick turnaround on pre-approval

- No credit score impact

Got a Few Questions First?

Let’s talk it through. Book a call and one of our friendly advisors will be in touch to guide you personally.

Schedule a CallNot Sure About Your Next Step?

Skip the guesswork. Take our quick Discovery Quiz to uncover your top financial priorities, so we can guide you toward the wealth-building strategies that fit your life.

- Takes just 5 minutes

- Tailored results based on your answers

- No credit check required

Related Posts

Subscribe to our newsletter

Get new posts and insights in your inbox.